Sales: 93283 94945

Support: 0261-2369109

-

- Sales: 93283 94945 Support: 0261-2369109

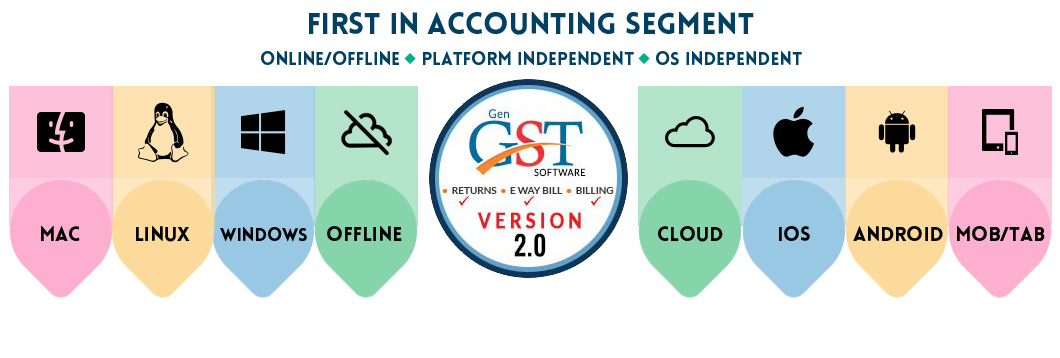

Gen GST software, a complete GST solution is designed and developed by SAI Infotech Pvt Ltd (Jaipur, Rajasthan, India) and is available in both Desktop and Online variants. The desktop variant is based on .NET Platform and the Online Variant is based on highly secured JAVA language. Our GST software (Billing, Returns Filing & e way bill) is OS independent (Online) which means that regardless of OS running on the system, the software is all set to work and operate on the desktop right away from the installation. The Gen GST software is available for free download or anyone can avail online GST SaaS service working on the cloud, accessible anytime anywhere giving on-the-spot assistance to the small businesses in India for GST billing, e-filing & E way bill purpose. Download free Demo.

The company has prepared multiple GST software modules that enables GST tax filing and invoicing work faster and easier all with the help of software. GST return filing is done online and the payments are accepted via Net Banking, Credit/Debit card, so considering the safety measures for professionals, the software will be integrated with secure payment gateways for secure payment transactions. Same goes for GST eway bill which is a mandatory form to fill up before transporting goods exceeding value INR 50,000, our software is capable to handle bulk e way bill generation, with registration and cancellation features attached.

As currently, there is a need of several GST returns filing per year, which accounts for GSTR 1, GSTR 3B and GSTR 4, etc making the task complex so to overcome this issue, the Gen GST software is compliant with every government prerequisites. Recently, CBIC introduced GSTR 9 (Regular Taxpayers) GSTR 9A (Composition Taxpayers) and GSTR 9C (GST Audit Form) for the annual return filing including all the transaction is done under CGST, SGST and IGST. The Gen GST is currently developing the annual return forms. Also, our GST billing software has the best user-interface presenting each and every feature displayed on-board used on a day to day basis. Indian businesses can generate specific invoicing format along with sales and purchase invoice, e-way bills, payment voucher, refund voucher, credit note/debit note, purchase RCM and more productive features by our billing software.